Key insights: Imbalance in the order book

I summarise key insights from a few papers studying the limit order book. You’l learn how to measure volume imblanace in the limit order book and how well it predicts price moves.

Forecasting currency rates with fractional brownian motion

Fractional Brownian motion is a stochastic process that can model mean reversion. Predicting future values turns out to be a simple linear model. This model has significant predictive power when applied to currencies.

Square root of a portfolio covariance matrix

The square root of your portfolio’s covariance matrix gives you a powerful way of understanding where your portfolio variance is coming from. Here I show how to calculate the square root and provide an interactive example to explore how it works.

Mean reversion in government bonds

Using the Ornstein–Uhlenbeck process, you can calculate the expected spread between bond yields of different maturities. These expected values can then be used to estimated the expected value of treasury ETF spreads.

Calculating the mean and variance of bond returns

Bond returns are a function of yields. Calculating the expected value of this function is quite difficult. You can take a Taylor expansion to make calculating the mean and variance of returns much easier.

How to get 100 years of bond ETF prices

The price of a bond ETF can be estimated from bond yields. You can use this technique to create a long term performance history of an ETF.

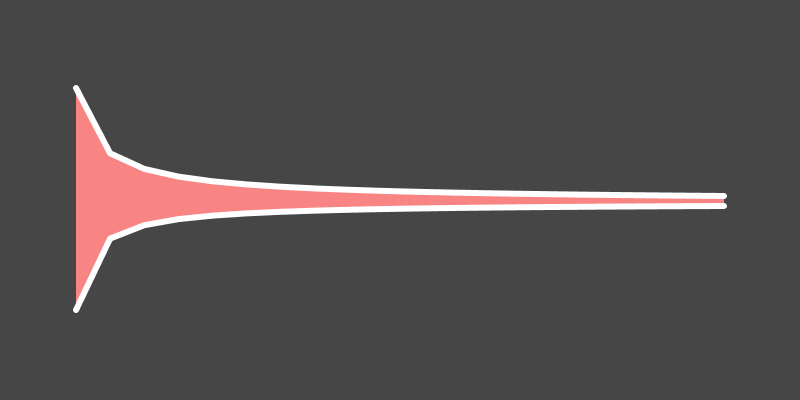

Understanding bond ETF returns

The return of a bond ETF can be estimated from bond yields. The distribution of a bond ETF’s returns turns out to be a function of the interest rate, expected change and variance of the interest rate. Bond returns are skewed depending on the interest rate’s level.

Invest regularly

Successful investors combine lots of simple things, each one providing a small improvement. One of these simple things is investing regularly.

Measuring performance

How can you measure performance when investing? You might think you can simply measure how much money you make. However, this can lead to losing a large portion of your capital. I want to show you why that can happen and how I measure my own investment performance.